When a newbie is a highly competitive market environment, he should know that will withstand the most brilliant minds and sharpened the business. The economic survival of these people depend on their best solutions.

Given this, the question arises: is there anything that a newbie can do to take "its place in the sun?"

The answer is obvious: think of trade as the daily business process: plan deal with relevant technical and fundamental research, make detailed preparations before the opening of the market, use the optimal trading strategy closely aligned with risk management and money. Get proper training and do not neglect your health, including psychological aspects.

Trading as a Business

Those of us who have some experience in the business readily accept that it was impossible to start any business without a plan, not only for starting a business, but also for his conduct during a certain time after the business began to grow. Despite this, most new businesses fail within the first two years.

In the absence of a trading plan, every decision is made randomly, and many novice traders go out of business trading for several months. It is natural that a person can be considered as a trader after trading a minimum of three years on the market. And even then, his well-being depends on the degree of adaptation and applicability of the learning curve to the three mandatory parameters: psychology, risk management and capital, and carefully-selected trading strategies.

The beginning trader should look to any successful businessman in another area: first, examine the selected business, so you know, it is vitally important, and what's not to stay in this business. For example, you will find that capital preservation is the single most important component of business success. No matter what you do, you should always remember that!

Forget about finding the best deals of his life. First of all, take care to preserve capital, and the rest will come later!

When a novice businessman opens a business, it must be ready, at least, they operate immediately, even if this would be done somewhat spontaneously. This method is called "learning in the workplace." If a business is fairly simple, this type of training can work. But if the business is more complicated and you are up against it the best and the brightest minds (as in trade), then this option will not work!

The set of transactions

Aspect of trading as a business, which shows how bad the "learning on the job" works when you start to trade for a living - most people do not know that there are three types of transactions, rather than two, long, short and "out of the market!"

Novice trader who first learns how to execute a warrant and then how to trade, may think that moving up enough to open a buy position. Why not, because novice traders believe that will always be able to leave if the market moves against them!

But they do not incorporate the effects of human psychology - in the long run, many newcomers are often transferred to their intra-day transactions in the position. With this approach, and using this rate, the entire trading capital a trader can be destroyed in an instant.

Trading is a business, not very different from any other kind of business. Its only product is money - money used to make money. Therefore, we can say that trade is the only business where the loss of money is the norm for the business!

All this leads to understanding critical to the success of the trade aspect - the difference between the loss of a "small part" in the middle and far less consistent wins (as in the following example Dax, where the eight losses, compared with just two wins). Once you learn how to lose those "small parts", then and only then, you really start making money!

Surprisingly, the majority of novice traders believe that there should be more than 51% winning trades to eventually make a profit. In fact, most consistently profitable traders have a share of profitable trades less than 50%.

The calculation is quite simple. If you constantly use stop-loss value of 200 Euros (8 points on the DAX) and have a losing streak in eight deals from 10, the total loss will amount to 1.600 (8 * 200). It is worth mentioning that the losing streak in eight transactions is unlikely to well-trained trader.

So, we've got two winning trades. Let's see, is there enough profit in it to offset the total losses. If we look at the hourly chart Dax February 27, 2009, we see that the price dynamics for the day was as follows: morning swing up to 30 points, then swing down to 142 points, the oscillation at noon at 122 points and swing down in the evening 60 items.

Now, let's calculate the hypothetical return of the two transactions of this day, let us assume for minimum vibrations at 60 and 30 points. If we calculate the total profit of 90 points on each transaction, we obtain 2.250 (90 * 25). Thus, the difference between the profit and loss will amount to 650, meaning that after such an incredible losing streak, we still obtain a profit.

In addition, if we go ahead and assume that the trader was a member of these two transactions only after the third has already occurred first oscillation (28.8% of traffic), we see that there is no loss, no gain. Losses are losing series win two lucrative deals.

Now, when it became clear that, in reality, we need only 2 out of 10 trades to be profitable, let's go further and try to understand how this can be done day after day.

Find a mentor

In my opinion, the path to profitable trade passes through the study, and the shortest and most efficient route - with the help of a qualified instructor.

To be successful in trading, you need to do one of two things:

Learn on their own

However, this option would require a lot of time and money. In addition, you will likely not be able to adequately cover the principles of money management and psychological aspects of trading to be able to properly and systematically apply them in their trading. Those two things work together for most of the shopping process.

Furthermore, even if you are able to independently cover these concepts, you will need several years to see measurable results - if you're in this time will not get from the market or lose your entire trading capital!

Learn from a mentor

This method takes much less time, and the financial result will be more noticeable, because the money spent will be compensated in the future.

I believe that trade is a profession! She can not deal with improvised, as most people think of beginners. If you act as your mentor, then paid him the money you would have lost in the market, not knowing how to be consistent and, therefore, profitable.

In addition to being a mentor should be a good teacher, he has to be a successful trader. He must have modern shopping techniques to maintain and improve its own sequence in the trade. Ideally, if the mentor will be to any professional organizations (such as the Association of Technical Analysts of the market), which maintains high ethical standards for the science of technical analysis.

Psychological aspects

Regardless of whether you decide to learn on their own or with the help of a mentor, you should know that trading is not only a variety of tasks, but also a strong psychological challenge. In other words, the knowledge itself will help you climb the path of study.

First of all, you must have the appropriate commercial capital, to its disadvantage as not to disrupt your work. The required initial capital depends on the market. For example, to trade index futures, you need at least $ 25,000, and the E-Mini market or forex, you can start trading with $ 1,000 or even hundreds of dollars and increase the expense. However, it is better to start trading with full capitalization.

In this case, it would be a huge mistake to use borrowed money! Using borrowed money to trade will hinder the attainment of full mental capacity, because you'll always have the fear of losing money!

Then, the question of confidence. Nothing can be done without it! No one trader will not use a trading strategy without having full confidence in its effectiveness. However, the acquisition of confidence is quite a difficult process! Takes many months, even years, to meet with the best tools that you have checked and rechecked, and which provide the best trading results! Confidence is based on test routines and rituals. However, this is - the only way to get the proper experience and move to the next step of studying the trade craft.

Now is the right attitude as the most important component of the performance of required tasks. I highly recommend "perseverance" as the most important of relationships. When you persevered study, and subsequently find that they must make a difficult decision, you'll be undisturbed, because you know the chances of pre-and because they had seen the same thing has worked before.

And, anyway, the loss was planned, and you can not lose more than a "small particle". After a losing streak or, conversely, the huge profits you have to experience the same mood: serene, the absence of any remorse and willingness to start all over again.

Your attitude is based on the belief that you received from your experience. Keep in mind that the frustration and joy arise quite often in the course of trade. But, appearing under pressure, you should never change their attitude. There will always be another day and will be the new deal, if you saved your trading capital losses following the rules of "small particles".

As you can see, the basis of learning and trade consists of three parameters: the psychology, risk management and money, and trading strategy, in that order.

Trading Plan

Even if you're lucky and you have found a consistent and profitable trading technique, there is a problem with its adaptation and use!

In this case, useful in research and commerce is a method of building blocks or modules of knowledge, because they are unique and easily adaptable.

Modularity helps to keep in mind and apply what has been learned. Concepts need to be simplified so that a newbie can understand them quickly without any or with very little previous knowledge of technical analysis.

Managing the trade may be optimal only if it was prepared in advance. This is done by using the trading plan, which shall include procedures to be strictly followed at every step of the trade.

Trading plan almost makes the trader to obey a set of common rules by which he guided to respond to market activities organized, predetermined manner, rather than reacting to them under the influence of emerging emotions. Without a trading plan, traders will be forced to improvise, that's not the best solution in times of stress.

Execution of a trading plan is completed the introduction of completed transactions in a trading journal, which serves as a sort of ledger "just-executed" trades. You should record all your actions to execute the transaction.

Thanks to conduct trade magazine you will have the best chance to not only remember what you did, but why did you do it, not just the steps you have taken in the current transaction, but also how they relate to any general "lessons learned". Below is given a list of some things that need to be covered in your magazine, which is by no means exhaustive:

· What is the main reason that you made a deal?

· Transaction evolved, as expected?

· How would you rate the feasibility of the transaction?

· How much risk (conservative or aggressive) you take, and whether this risk was the best option?

· Whether there were any hidden aspects of the transaction?

what suggestions can you do that would improve on the deal, whether or not you could take them?

In addition, the trader should try to get some statistics from his journal, which will undoubtedly improve trading results.

Without a prepared a strategy carried out with the proper tactics, the probability of the transaction will always be equal to 50/50.- When, why and how

For better understanding, I will use the simple principles of 'when', 'why' and 'how' to explain the management of the transaction.

The principle of "when" - is the initiator of the transaction. In other words, it is - a factor of timing of the transaction. This not only signals the preliminary phase, but also signals to the stage of commerce.

The first may be, for example, a candle, "doji" (a bar of uncertainty), or any reversal pattern. The second "takes the baton" from the pre-signal and transforms it into the final signal, expressed a strong and compelling way: open bar above the high of the previous candlestick "doji", input / output indicator in the area of overbought / oversold bounce on the level of Fibonacci, the median test line and so on.

The principle of "why" - is evidence of momentum factor double the time period and mandatory for a profitable outcome. The most common example is the alignment of time periods - the upper with the lower (sales) period.

We can do this either to confirm both the price chart, or to see, as an indicator of growing on the same chart. We usually focus on the development trend in the larger time frame, expressed its market price and / or indicator, which coincides with the direction of the price dynamics of the signal indicator or lower (trading) time period.

This is a very important tool of trade, without which a trader must not make any deals. It should be remembered that not every alignment time periods will result profitable. As soon as the alignment of periods, it may be accompanied by other factors, confirmation, such as bars break above / below the trend line, which may be moving average line bias or any orthodox or unorthodox trend lines or levels, indicating the resistance and support.

The principle of "like" is an operational factor trade, required for a profitable outcome. This final principle will come into force as soon as there have been successfully pre-alarm and signal phase. It covers the entry and exit from the market-related risk management, as practice of the three steps - the procedure for executing transactions with the preparation of the three orders. It also represents a guarantee of consistent profits.

Three-step technique

This innovative technology consists of three steps:

Step 1: Find the most optimal entry and place the first order.

Step 2: Find the best position to stop and then place it immediately after the execution of a warrant of entry.

Step 3: Find the most reasonable profit target and then calculate the optimal ratio of profit to risk, which should not be less than 2.5 (the ratio may be less if the deal with a very high probability). Do not forget that the main purpose of the trader - the preservation of capital. There will always be another possibility, but only if you still have the trading capital. Therefore, we are looking for a deal with low risk and high probability.

That is - a working example:

· The stage entrance - 1-3 ticks above the high "doji".

· Stage stops - 2-4 ticks below the low "doji".

Stage profit target - the first goal on the median line (ML) and the second goal in the upper median line (U-MLH) Andrews' Pitchfork.

As the price, always consider the last swing with its highs and lows. Also be aware of Fibonacci retracement levels of price and time, and not only the last oscillations of the correction, but also a vibration latest trend.

Most of the time these three consecutive steps are prepared in advance - at a time when trading decisions. To preserve trading capital is very important to observe the condition that once were set stop and limit order, they should not be changed.

Because of the reliability and automatic nature of this technique, I called it an automatic way of trade. If only two orders prepared in advance, then we are in a semi-automatic mode.

Three-step technique (or even can be called "technology of the three orders") should be carried out every day, no exceptions. It requires discipline and patience. A trader must achieve a high level of routine, always double-check their well-informed decisions and actions.

For those traders who fully adapted this technique, it is a guarantee of consistent profits.

I strongly recommend that all traders have passed six steps of the trading plan: a preliminary signal, the main signal, confirmation, login, set stops and profit targets.

Scheme of the trade.

trading Strategies

We in this paper has not considered trading strategies, because, in my opinion, this is the least important factor in obtaining a consistently profitable results in the trade.

Certainly, without precise strategy, there will be no trade, but I think the main part of a strategy of trade, which is of importance since the other two parameters (psychology and risk management / money)!

From the available arsenal of trading professional trader, I will mention three principles of trade, which can be used for profitable trading: trend, lateral movement associated with resistance and support, and variability. Format this article does not allow to describe them all, so we consider only some of which I consider as a basis for transactions with low risk and high probability.

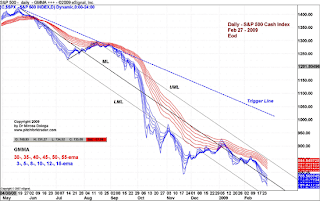

I have created integrated analysis for the detection of Andrews' Pitchfork (in front of a crowd of the market) development trend. Using this tool will give professional traders an advantage. I will illustrate it in the following charts:

We in this paper has not considered trading strategies, because, in my opinion, this is the least important factor in obtaining a consistently profitable results in the trade.

Certainly, without precise strategy, there will be no trade, but I think the main part of a strategy of trade, which is of importance since the other two parameters (psychology and risk management / money)!

From the available arsenal of trading professional trader, I will mention three principles of trade, which can be used for profitable trading: trend, lateral movement associated with resistance and support, and variability. Format this article does not allow to describe them all, so we consider only some of which I consider as a basis for transactions with low risk and high probability.

I have created integrated analysis for the detection of Andrews' Pitchfork (in front of a crowd of the market) development trend. Using this tool will give professional traders an advantage. I will illustrate it in the following charts:

- As you can see in the chart above, price movements are associated not only with the support and resistance lines on the chart, but also with the trend lines on the display. Each oscillation seems closely monitored! The emergence of mirror bars at approximately 1.000 indicates that the strong upward gradient has exhausted itself, reaching the inevitable reversal.

The daily chart of S & P500. Integrated analysis of Andrews' Pitchfork.

- The above graph illustrates the use of integrated analysis of Andrews' Pitchfork is an instrument with GMMA Guppy bestowed. I have studied this combination for a while and always wondered its brilliant results!

conclusion

Again, I repeat, that some confusion inherent in the trade, does not deny her communion with the other businesses. This is true not only of the business plan, which is trading plan for traders, but also in designing the learning curve through well-crafted plan of study, based on the modules.

Guideline trader as "the owner of a retail business," is that without a specific plan prepared in advance of trade, carried out by means of effective tactics, trading is no different from a random rate of 50/50.